Can’t-Miss Takeaways Of Info About How To Choose Managed Funds

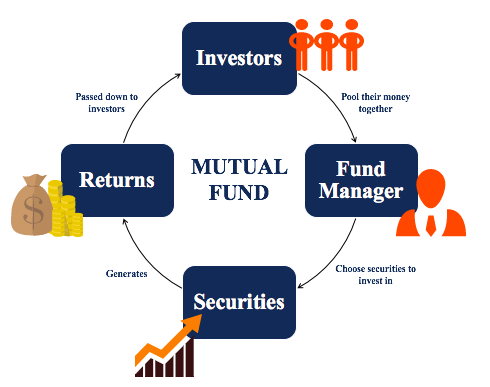

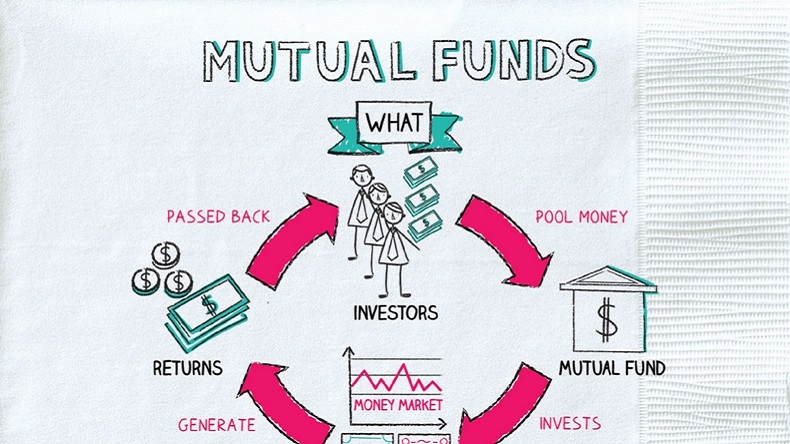

Managed funds come in all shapes and sizes and it is important to understand the basic differences so that you can choose a fund to suit.

How to choose managed funds. Make sure the manager's compensation is tied to. Fees are often higher for active funds. Nothing will motivate a manager's performance more than his own bottom line.

Active funds seek to outperform a benchmark index, depending on the type of fund. Based on 2021 data, the average expense ratio for an. Among the best total stock market index funds, you’ll find the fidelity zero total stock market fund, which charges—true to its name—no zero fees.

One of the most important decisions. Register with lovemoney.com and connect with clever people, personalised content and. You've known us for leading the indexing revolution.

Choosing a fund because it has the lowest charges could be a false economy as returns after costs are important. What will it invest in? One of the most important decisions for investors when constructing a portfolio is to choose a fund manager.

Choose your managed fund type. But we recognize some investors follow different paths to financial success. Look for a manager with skin in the game.

It's important to look beyond the numbers. It’s better to pay a little more for a fund that should perform. A sharpe ratio compares the risk and return of the fund.

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)